2021 has been a strange year for property investment. The future of the housing market has never seemed less predictable as people scramble to make sense of the new post-lockdown paradigm. However, in all of this strangeness, Melbourne has still managed to thrive, reaching record highs at a time when many in the investment industry were expecting the worst.

Melbourne is still home to some of the top suburbs for property investment in Australia, and with the demand for property steadily growing across the board, now is a perfect time to consider buying. Data suggests that, as of September 2021, the median house price for properties in Melbourne rose to $1.038mil, a record high for the city. Many have speculated on why this might be, but one compelling reason is that the RBA lowered interest rates, stirring a large amount of interest.

The city’s one-bedroom apartments hold the highest rental returns in Victoria, and with so many previously slept-on suburbs on the rise, there’s a lot to get investors excited. However, recent increases in properties built coupled with decreases in the number of incoming travellers mean that success in the property market is all about location and planning. In other words, finding the right place to buy should always be at the top of your priority list. So, to help you through the process, let’s take a look at Melbourne’s top suburbs for property investment in 2022.

Primarily known for Knox Shopping Centre, this is a perfect example of a Melbourne suburb on the rise. With a median home price increase of over 19% compared to the previous year and new infrastructure plans always on the horizon, this area and its surrounding suburbs have never been more in-demand. Whilst interest is increasing, and the past few years have seen a drastic increase in prices, it’s still not at the point of being inaccessible to new homebuyers. So, if you’re considering a first homebuyer opportunity, Knoxfield is certainly a place to consider.

Compared to similar suburbs, Mordialloc has seen a slow rise throughout the 2010s, and whilst it has been on the radar of some investment insiders since as early as 2014, it’s only now that people are really starting to pay attention. Average rental listings have hit the $550 mark, which goes far in explaining the over 40% increases in median prices overall. Whilst it may not be the name that immediately springs to mind for the hottest destinations, it does offer many elements that homebuyers love, including the beautiful Mordialloc Beach, Mordialloc Pier, and an abundance of reserves, creeks, dog parks and more. For anyone that is looking for a getaway with all the modern conveniences of a city, Mordialloc is absolutely a destination to keep an eye on.

At first glance, the idea that Melbourne is one of Melbourne’s top suburbs for property investment seems obvious. However, with a recorded value increase of 6.87% in the median house price, and with value projected to rise over 2022, central Melbourne is a definite hotspot for potential investors.

While the central business district isn’t exactly known for having a large number of houses, that doesn’t mean you’re limited for choice. From refurbished historical apartments to warehouse and laneway conversions, Melbourne is filled with unique properties that are perfect for investment opportunities. Plus, as concerns over first homebuyers having difficulty entering the market have become more widespread, more and more options have been made available exclusively to those entering the market for the first time.

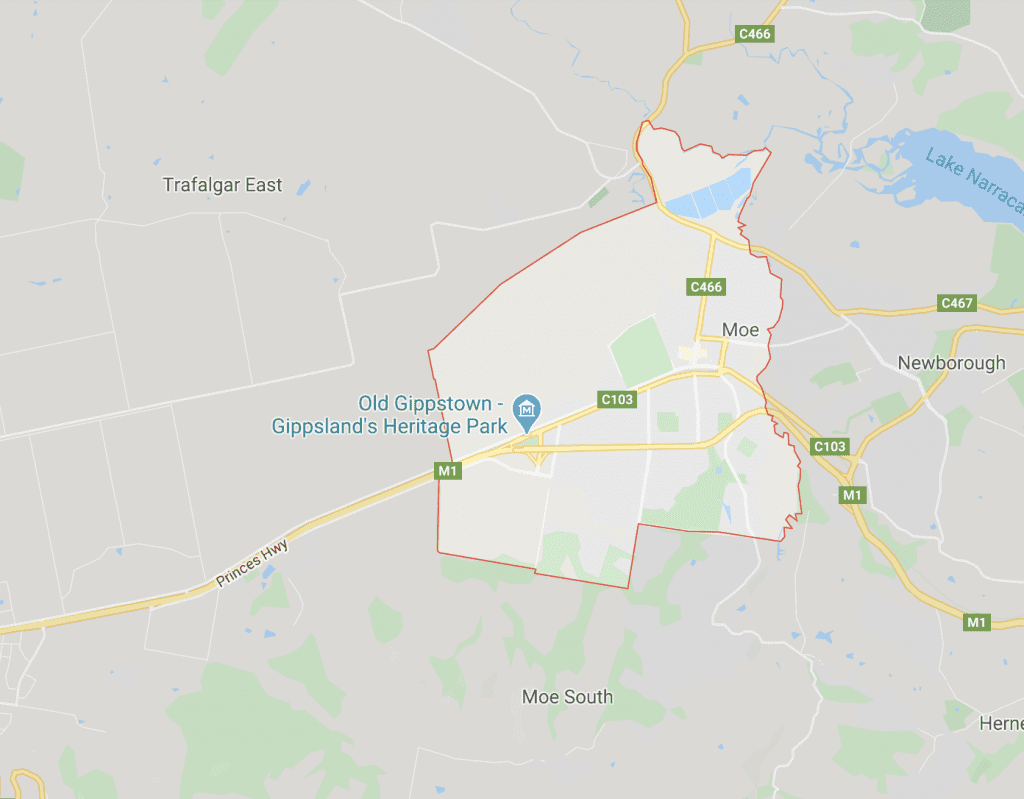

Stepping well-away from the city sprawl of Melbourne’s CBD, Moe is one of the unsung heroes of investment suburbs. Located 120km east of the city, Moe’s growing economy and agricultural landscapes are often passed up by investors for its more well-known counterparts around Gippsland and Latrobe Valley. However, good investing comes from areas on the rise, rather than those that are peaking, and Moe has seen a consistent rise in house prices and rental yield throughout the previous decade.

With one of the highest rental yields in the state, and a median house price of $295,000, Moe is definitely a suburb to pay attention to.

Another oft-overlooked suburb on the property investment map, Stawell’s gross rental yield of 6.2% more than makes up for the lack of brand recognition. Investment opportunities have been spreading out to regional areas over the past few years, and that shift has led to a considerable amount of growth for places like Stawell. With a median house price of under $270,000, Stawell is perfect for those looking to get into the Real Estate market.

While many investors have shied away from putting their money into Southbank due to occasionally-exorbitant house prices, the highly sought-after suburb is starting to see a shift toward affordability. As median house prices have dropped significantly since 2016, from $565,000 to $535,000 at the end of 2019, average rental prices have stayed consistent at around 5.50%, with rental demand still very high. In other words, it’s far more affordable to buy in Southbank, whilst still offering the same high rental yield. Where’s the downside?

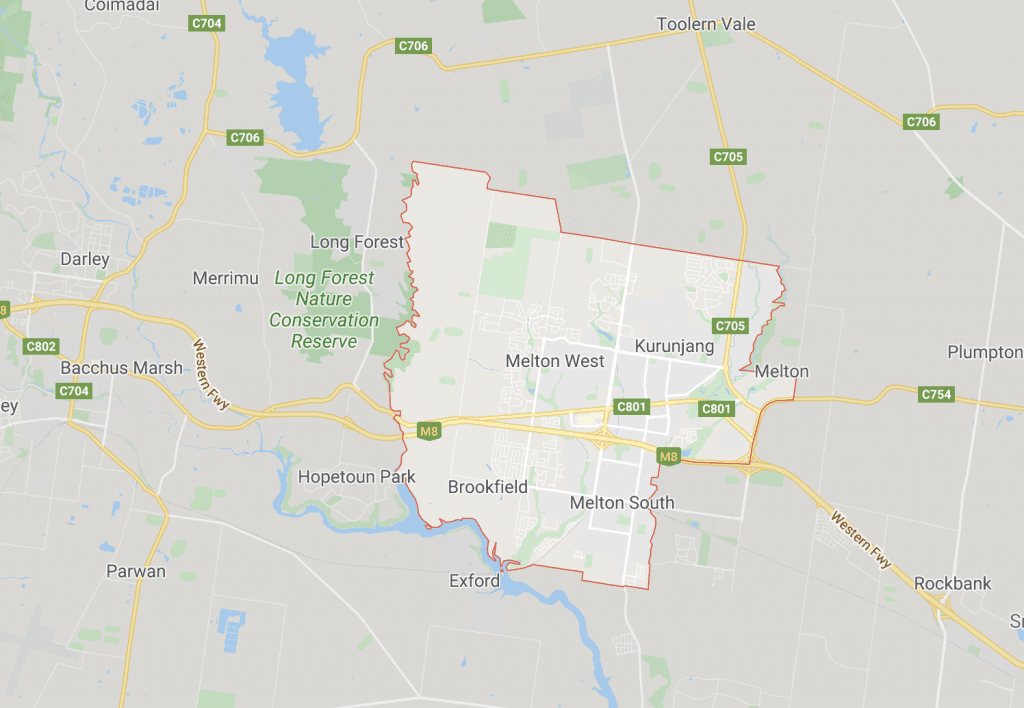

As we touched on earlier, finding the top suburb for property investment means finding suburbs that have strong potential for growth, and Melton more than offers that upward trajectory. With median house prices at an affordable $385,000 and a gross rental yield of +4.3%, Melton is definitely a suburb worth looking into as an investor.

~

Being a property investor comes with a lot of responsibilities, so why not let My Rental take some of that stress off your hands? As one of Australia’s most innovative, trusted property management services, My Rental is dedicated to providing property owners and investors with comprehensive management at an affordable price. Contact My Rental today to see what we can do for you.

Keep up to date with our experts' latest investment strategies and property management tips. If you are looking for any case studies or further information about the greater Melbourne area, speak with our property managers today.

Better property management starts here. Get your no obligation free rental appraisal and property report.

Get free report