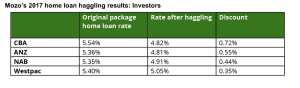

At financial comparison site Mozo, we’ve recently conducted our annual home loan mystery shop, and found that all four of the big banks were willing to slash interest rates by up to 0.72% for investors.

That might surprise you, given APRA’s clampdown on investment lending this year, but it seems lenders are still keen to put the right kind of borrower on their books.

So what’s the catch? Well, to get these lowered rates, you might have to work for it.

When you’re dealing with a bank eager to negotiate, getting a discount might be as simple as asking for it. In our haggling experiment, CBA was keen to give out discounts and wound up dropping its 5.54% package rate by a huge 0.72%.

On the other hand, in order to get these discounts, you’ll sometimes have to really dig in and argue for them. For example, Westpac only grudgingly gave up a 0.35% discount on its 5.40% package loan.

If you’re trying to squeeze a better deal out of a less willing opponent, I’ve found that one of the best strategies is to ask them to price match a lower offer from a competitor. When it comes to the big banks, the reality is you can nearly always find a better deal from another lender through a quick home loan comparison, and then ask your preferred bank to match – or better – it.

The other option, of course, is to get your home loan with the lender who gave you the best deal in the first place. Often, you’ll find you get the lowest rates and best value from smaller or online lenders, who don’t have the same overheads to pay as big banks.

In fact, moving your property management – including mortgage – online can be surprisingly valuable. It often means not only lower interest rates, but lower fees and more often than not, these digital lenders and property managers are the first to embrace innovations that could save you money, or streamline your investment portfolio.

To put it in perspective, you might save $76,000 in interest by haggling a 25 year, $600,000 CBA home loan down by 0.72%. But by choosing an online lender with a low 4.13% interest rate, you could save as much as $146,000.

Those kinds of savings speak for themselves, really, but it’s also important to make sure you’re comparing apples with apples – a higher rate loan with an offset account may wind up offering better value than a no-frills low rate option in the long run.

And that’s where haggling comes in. Find the mortgage offer you want, with all the features you think you’ll use, and then negotiate your way to the best possible deal. Or, maybe the bank would be willing to waive the service fee, or the offset account fee, to make a full featured home loan more affordable – it’s not all about the interest rate, after all.

Above all, remember: if you don’t ask, you don’t get.

Steve Jovcevski is Mozo’s property investment and lending expert. With an extensive knowledge of home loan products and property trends, Steve is full of practical tips to help first homebuyers, refinancers or investors build and get the most out of their property portfolio.

Keep up to date with our experts' latest investment strategies and property management tips. If you are looking for any case studies or further information about the greater Melbourne area, speak with our property managers today.

Better property management starts here. Get your no obligation free rental appraisal and property report.

Get free report